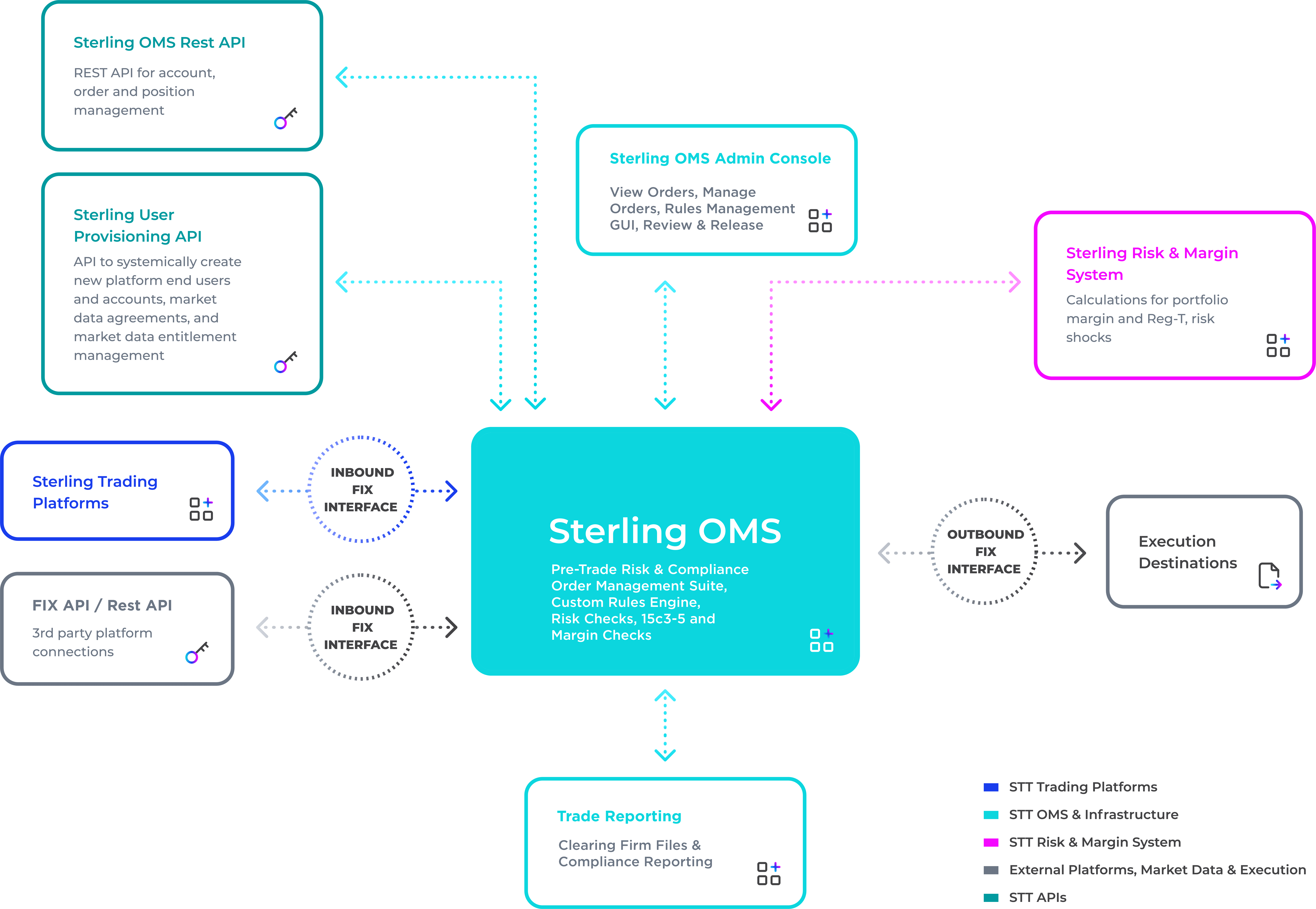

Set and update pre-trade risk controls, manage and interact with order flow and positions in real-time via either the STT REST API or advanced OMS Console.

Scale your business with the ability to support up to 2,000 orders per second.

Clients can utilize STT’s OMS across single or multiple clearing firms.

STT OMS supports end-of-day compliance reporting and detailed trade reporting to seamlessly integrate into existing back-office processes.

Sterling’s infrastructure solutions offer global connectivity to multiple exchanges and trading networks along with on demand custom development solutions.

The Sterling OMS is a high-performance order processing system. It offers real-time balances and positions, advanced margin methodologies, customizable risk controls, broad reporting capabilities, and a network to market destinations are all available to customers.

Highlights:

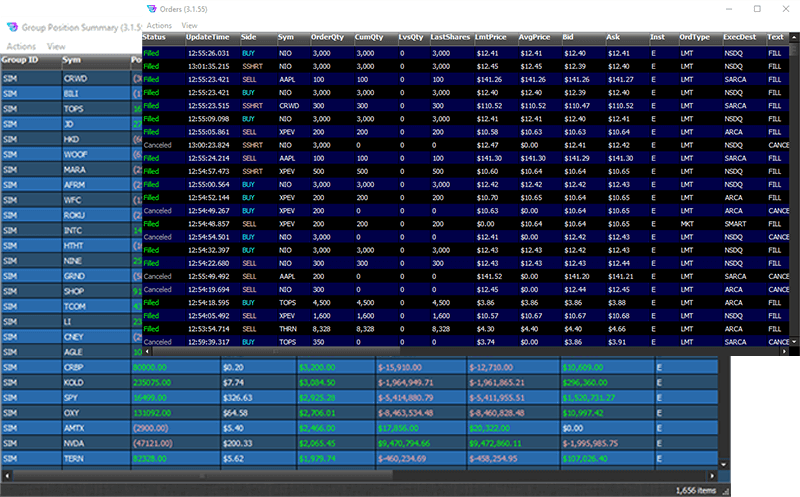

Sterling OMS Admin Console is the dashboard and control panel for the OMS’ operations and workflows.

Highlights:

Ability to calculate pre-trade margin calculations for options including utilizing the risk reducing properties of spreads

Ability to define custom rules for pre-trade checks

Satisfy your customers’ needs to trade in less than whole shares

Support of conditional orders for advanced trading strategies

Distribute order flow based on defined rules or randomly

Provides the ability to view credit and cost impact of orders to help investment decisions

Define rules results for a second look at orders

Ability to use algorithmic order types with several providers

Select from a menu of order validation and risk exposure pre-trade controls

Connect to a major crypto trading and clearing service

Data Center Location:

Secaucus NY4

Peak Message Rates Supported:

Up to 9,000 messages per second

Order Latency:

Less than 1 Millisecond

Hours of Operation:

2am EST to Midnight EST

Instruments Supported:

US Equities, US Options (single leg and multi-leg), CAD Equities

SOD Files Supported

Buying Power, Positions, Easy To Borrow, Non-Standard Margin

EOD Files Generated:

Clearing Files, Daily Trade Blotters, Order Lifecycle, Custom BD Reports

Platforms Supported:

All Sterling platforms; Third-party Fix APIs; Graybox; EZX; Succession; GoTrader; MarketTrader; ETNA; Valdi; Flextrade; DAS

Drop Copies Supported:

Inbound and Outbound Supported via Fix 4.2 for all instruments.

Risk GUI Available:

Yes. GUI available both for full risk control or in “view only” mode.

15c-3 Risk Controls Supported:

All 15c-3 Risk Controls Supported

Position Management:

Risk GUI allows clients full position and order management at both aggregate unit level and individual account level.

Pre-trade / Post trade Risk:

Aggregator risk controls are pre-trade; Post trade risk available with integration of Sterling Risk Engine (SRE)

Reject Notifications:

Orders that do not pass risk checks are rejected back to trader with easy to understand reject text notification.

Order Routing Controls:

Orders can be routed based on Aggregate Unit, Individual Account, Platform, Symbol, Listing Exchange, TIF, Order Type, Time and Price.

APIs Supported:

REST API (JSON); FIX API (FIX v4.2)

| Aggregate Unit Control | Individual Account Control | Equities | Options | |

|---|---|---|---|---|

| Order Side Marking | ||||

| Buying Power/Margin | ||||

| Night Buying Power Control | ||||

| Complex Option Margin | ||||

| Portfolio Margin | ||||

| Margin Based on Price | NO | |||

| Margin Based on Symbol | ||||

| Max Loss | ||||

| Average Daily Volume (ADV) Filter | ||||

| Duplicate Order Check | ||||

| Max Price Variation from Bid/Ask | ||||

| Max Symbol Concentration | ||||

| Set Options Levels Approved | ||||

| Pattern Day Trading Controls | N/A | |||

| Per Order Control – Max Quantity | ||||

| Per Order Control – Max Notional | ||||

| Per Order Control – Max Price Threshold | ||||

| Per Order Control – Max Open Orders | ||||

| Symbol Control – Symbol Blocking | ||||

| Symbol Control – Minimum Price Restriction | ||||

| Symbol Control – Maximum Price Restriction | ||||

| Position Control – Max Long Position Value | ||||

| Position Control – Max Short Position Value | ||||

| Position Control – Max Open Notional Value | ||||

| Rules Engine Pre-Trade Check |

STT can accept Start-of-Day data for all client accounts via automated upload.

SOD Position Uploads:

STT can load start of day positions for each client account from the clearing firm of record.

SOD Buying Power/Margin Uploads:

STT can load start of day account buying power or margin for each client account from the clearing firm of record.

Easy to Borrow (ETB) Lists:

STT can load ETB lists to determine which securities are easy to borrow for shorting in client accounts.

Locate Lists:

STT can load lists of securities that have been pre-located by the client for their accounts.

STT has the ability to generate End-of-Day data for all client accounts via ftp or file transfer.

Trade Reports:

STT can generate a nightly trade blotter that includes all executed trades and associated trade details.

End-of-Day Position Reporting:

STT can generate a position report to show all ending positions in each client account including account, ending position quantity and position price.

Clearing Firm Files:

STT can generate end of day Clearing files based on the specifications of each individual Clearing Firm.

STT has the ability to generate compliance data for client regulatory reporting to FINRA and the SEC.

CAT Reporting (Consolidated Audit Trail):

STT is fully certified for Consolidated Audit Trail (CAT) reporting and can generate CAT reports and submit on behalf of clients.

SEC 606 Reporting:

STT supplies 606 data in standard IHS Markit format only. STT is not a 606 vendor.

Lifecycle Reports:

STT can generate Lifecycle Reports that provide timestamped details of all order activity, including when orders are sent, confirmed, executed, canceled and rejected.

We look forward to learning more about your trading needs.